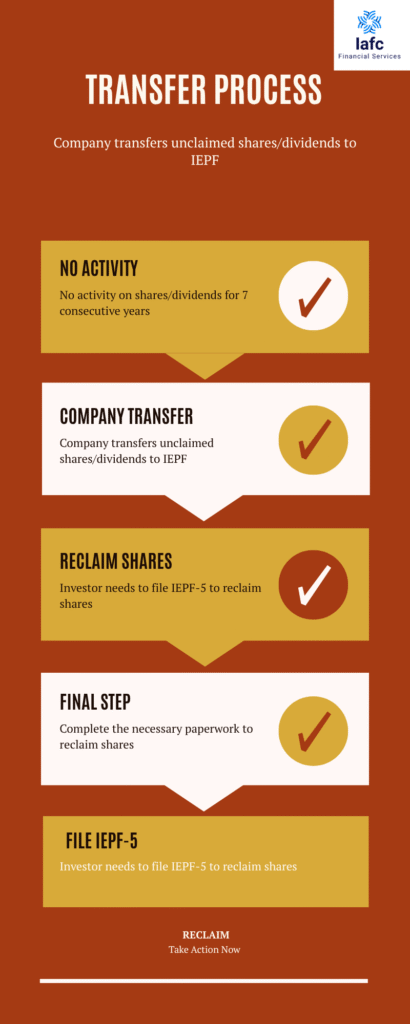

If you or a family member have unclaimed shares, dividends, or matured deposits, there’s a good chance they’ve been transferred to the Investor Education and Protection Fund (IEPF). The process to recover those shares or dividends may seem complicated, but it’s absolutely possible. In this article, we provide a detailed, step-by-step guide on how to file an IEPF claim smoothly and successfully.

This 5000-word article is meant to simplify the entire IEPF claim process for investors, legal heirs, or any individual who finds themselves in need of recovering financial assets from the IEPF Authority. Whether you’re a beginner or someone struggling to file the claim correctly, this comprehensive guide is for you.

⚠️ Important Note: While the steps may seem simple in theory, many individuals struggle to complete the IEPF process due to legal documentation errors, delays from companies, or lack of clarity in communication. Even a single mistake in the affidavit, wrong Demat details, or missing heirship documents can lead to months of delay or outright rejection.

That’s where IAFC comes in — our team of experts ensures your claim is filed accurately and professionally. We’ve helped hundreds of clients recover their unclaimed shares and dividends without stress, confusion, or wasted time.

Table of Contents

- What is IEPF?

- Why Shares or Dividends Get Transferred to IEPF

- Types of Unclaimed Assets Covered by IEPF

- Eligibility to File an IEPF Claim

- Documents Required for IEPF Claim

- Step-by-Step Process to File an IEPF Claim

- Common Mistakes That Delay Claims

- Timeline of the Claim Process

- How to Track Your IEPF Claim Status

- Legal Complications in IEPF Claims

- Tips to Ensure Faster Claim Approval

- Role of a Nodal Officer and How to Communicate

- Why Professional Help Can Make a Difference

- FAQs About IEPF Claims

- How IAFC Can Help You Recover Your Shares

- Call to Action

3. Types of Unclaimed Assets Covered by IEPF

IEPF deals with a wide range of unclaimed investor assets. These include:

- Unclaimed dividends

- Matured deposits and debentures

- Application money due for refund

- Interest on debentures

- Shares (both physical and demat)

- Redemption amounts

- Sale proceeds of fractional shares after corporate actions

Understanding what qualifies can help you assess whether you are eligible to claim.

7. Common Mistakes That Delay Claims

Even minor errors in your application can lead to delays or outright rejection. Common issues include:

- Not notarising the indemnity bond and affidavit

- Incorrect Demat account number or bank details

- Missing documents like legal heir certificates

- Not sending documents to the correct Nodal Officer

- Poor communication with the company

📌 Many claimants believe they can handle the process on their own, only to find themselves stuck for months in back-and-forth communication, legal confusion, and document re-submission.

At IAFC, we eliminate these hurdles. Our experts handle all paperwork, verifications, and follow-ups so that you don’t have to worry about errors or delays.

9. How to Track Your IEPF Claim Status

Once your claim is submitted and documents are sent, you can track the status online:

- Visit www.iepf.gov.in

- Navigate to “IEPF-5 Tracking”

- Enter your SRN (Service Request Number)

- You’ll get the current status — accepted, pending, or rejected

You can also email or call the Nodal Officer for updates.

10. Legal Complications in IEPF Claims

In many cases, the legal process isn’t straightforward. Some common legal complications include:

- Multiple heirs with no succession planning

- Disputed wills or lack of documentation

- Requirement of succession certificate from court

- Shares held in joint names with no nominee

In such cases, it’s strongly advised to take legal or professional help.

Trying to handle legal complications without professional support can increase the risk of claim rejection.

IAFC’s legal and documentation team ensures your case is presented with 100% accuracy and meets all government requirements.

12. Role of a Nodal Officer and How to Communicate

The Nodal Officer plays a crucial role in your IEPF claim process. They are the first point of verification. Tips to ensure smooth communication:

- Always address your documents correctly to the company’s Nodal Officer

- Follow up via email after submission

- Keep records of all courier receipts and email communication

- If no response in 30 days, escalate to the IEPF Authority

16. Call to Action

Ready to recover your lost or forgotten shares without the hassle?

Let IAFC handle the entire IEPF claim process for you — from document preparation to follow-up with the Nodal Officer. We ensure that your claim is submitted accurately, legally compliant, and with the highest chances of success.

Save time and effort

Avoid costly delays or rejections

Get expert support at every step

Visit: www.iafc.in

Email: support@iafc.in

Reclaim what’s rightfully yours — with no confusion, no errors, and no delay.